Who Really Runs China’s Web in 2025?

The story behind China’s browser landscape.

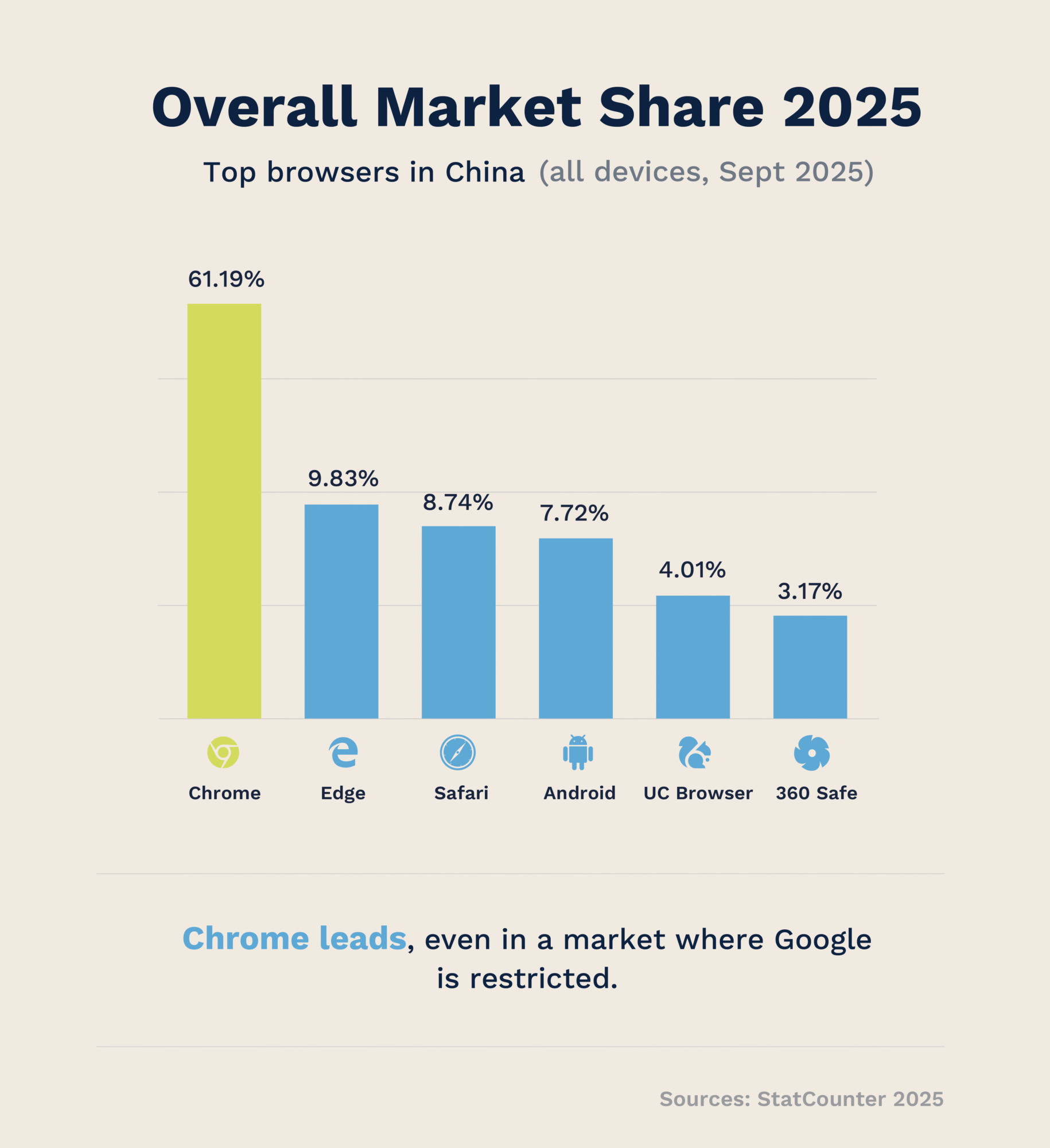

Overall Market Share 2025

Top browsers in China (all devices, Sept 2025)

- Chrome: 61.19%

- Edge: 9.83%

- Safari: 8.74%

- Android: 7.72%

- UC Browser: 4.01%

- 360 Safe: 3.17%

(Sources: StatCounter 2025)

Chrome leads, even in a market where Google is restricted.

Why Chrome Leads Despite Restrictions

Although Google Chrome itself faces limits in China, its underlying technology (Chromium) powers most major browsers.

- Many Android browsers use Chromium by default.

- Users enjoy speed, reliability, and cross-device sync.

- Market data often counts these variants as “Chrome.”

In practice, Chromium powers China’s browsing experience.

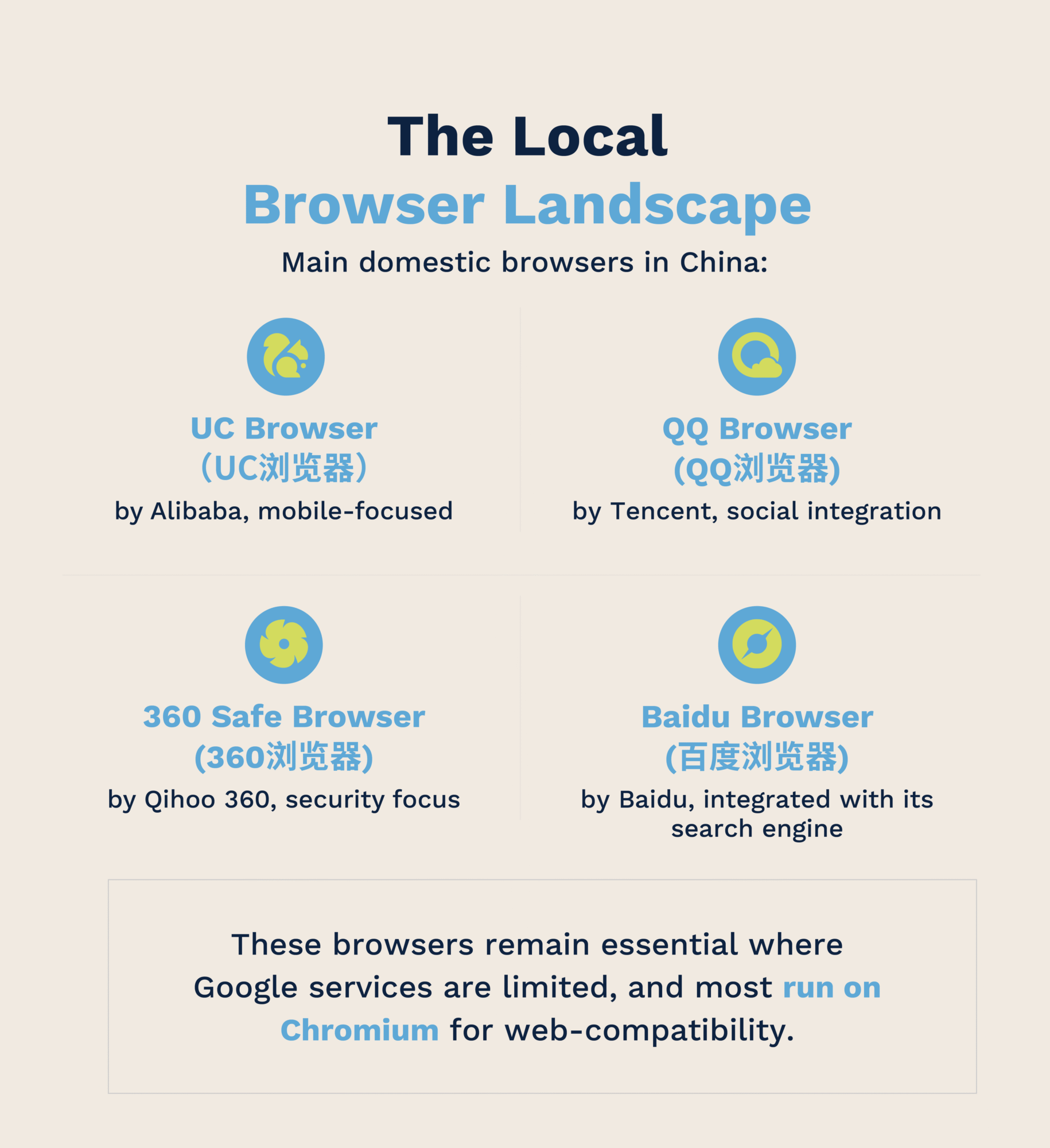

The Local Browser Landscape

Main domestic browsers in China:

- UC Browser (UC浏览器) – by Alibaba, mobile-focused

- QQ Browser (QQ浏览器) – by Tencent, social integration

- 360 Safe Browser (360浏览器) – by Qihoo 360, security focus

- Baidu Browser (百度浏览器) – by Baidu, integrated with its search engine

These browsers remain essential where Google services are limited, and most run on Chromium for web-compatibility.

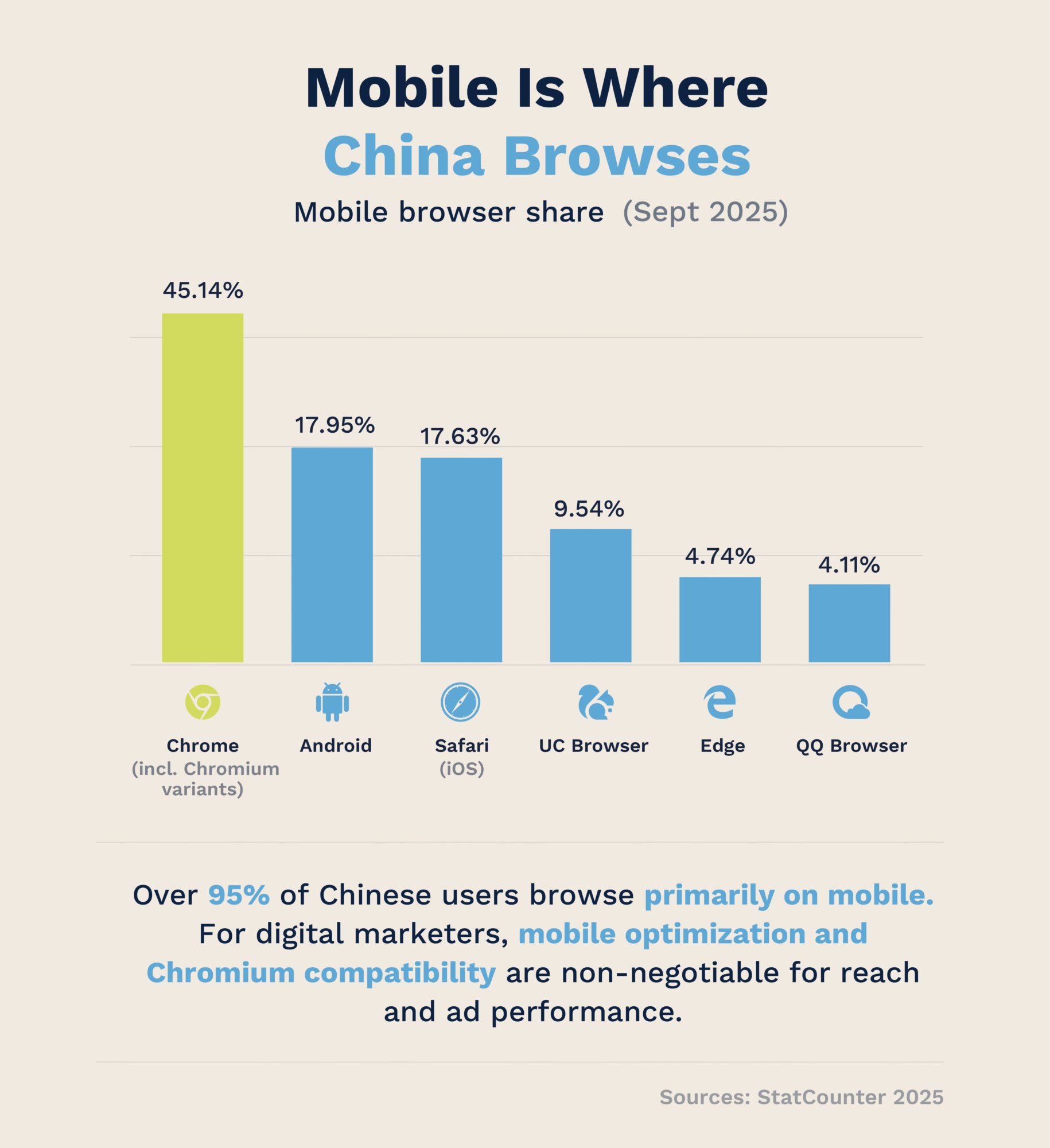

Mobile Is Where China Browses

Mobile browser share (Sept 2025):

- Chrome (incl. Chromium variants): 45.14%

- Android: 17.95%

- Safari (iOS): 17.63%

- UC Browser: 9.54%

- Edge: 4.74%

- QQ Browser: 4.11%

(Sources: StatCounter 2025)

Over 95% of Chinese users browse primarily on mobile.

For digital marketers, mobile optimization and Chromium compatibility are non-negotiable for reach and ad performance.

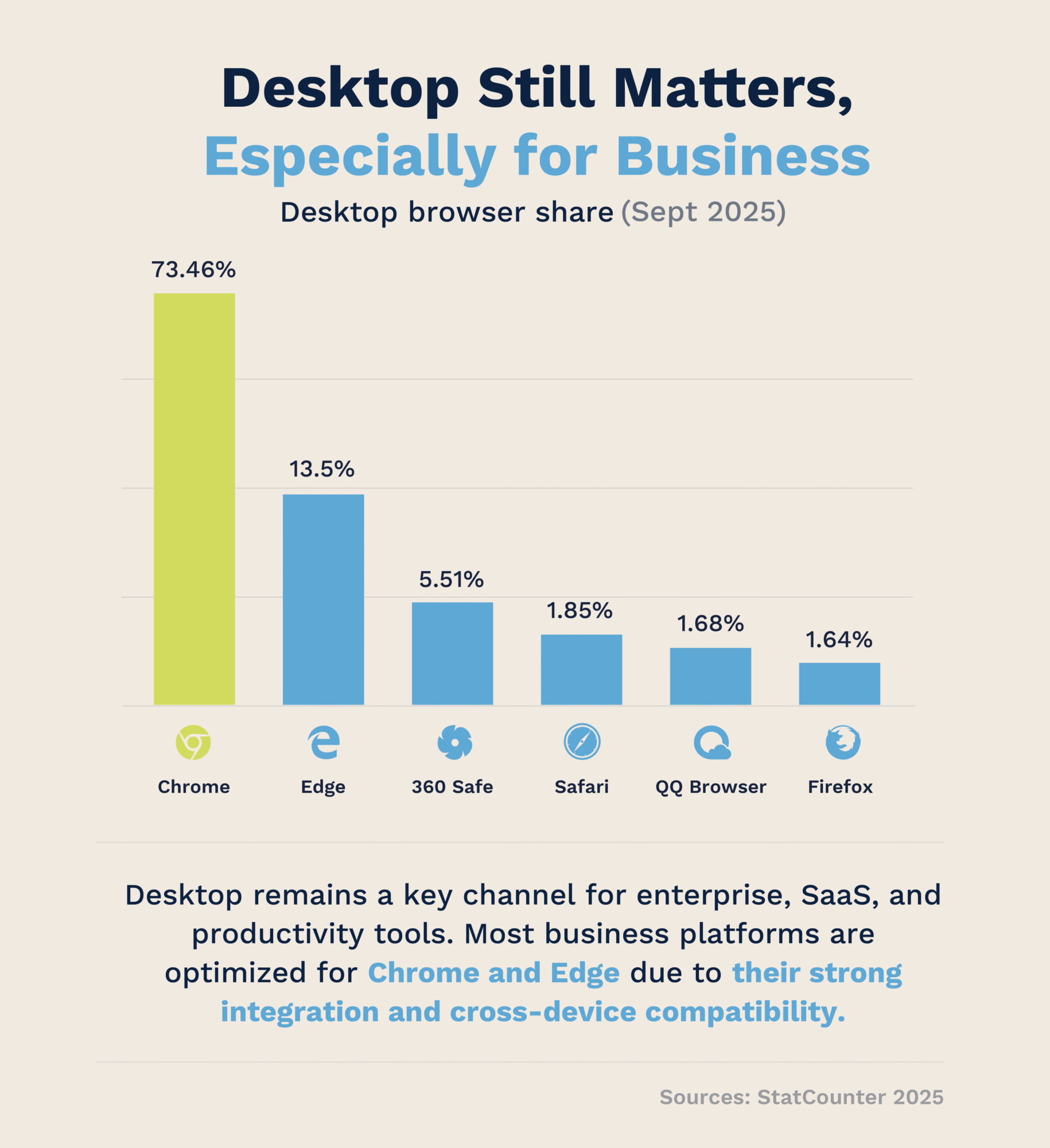

Desktop Still Matters, Especially for Business

Desktop browser share (Sept 2025):

- Chrome: 73.46%

- Edge: 13.5%

- 360 Safe: 5.51%

- Safari: 1.85%

- QQ Browser: 1.68%

- Firefox: 1.64%

(Source: StatCounter 2025)

Desktop remains a key channel for enterprise, SaaS, and productivity tools. Most business platforms are optimized for Chrome and Edge due to their strong integration and cross-device compatibility.

Trends & Opportunities (2021 → 2025)

Key shifts:

- Chromium browsers now power most of China’s web traffic.

- Local browsers are losing share outside their ecosystems.

- AI integration (voice, summarization, and smart search) is raising fast.

- OEM preinstalls and data localization continue to shape competition.

The next phase of competition will hinge on AI capabilities, privacy trust, and ecosystem integration, rather than just speed or design.